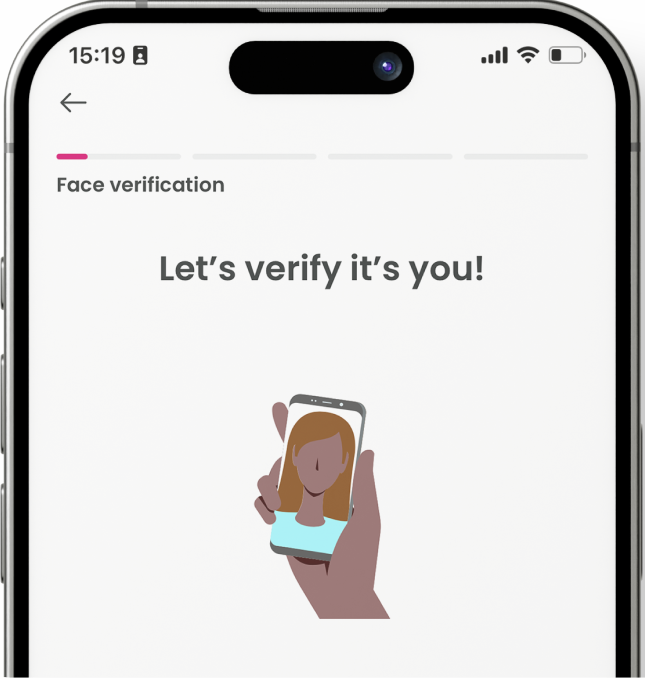

Submit your selfie, Ghana card

and address.

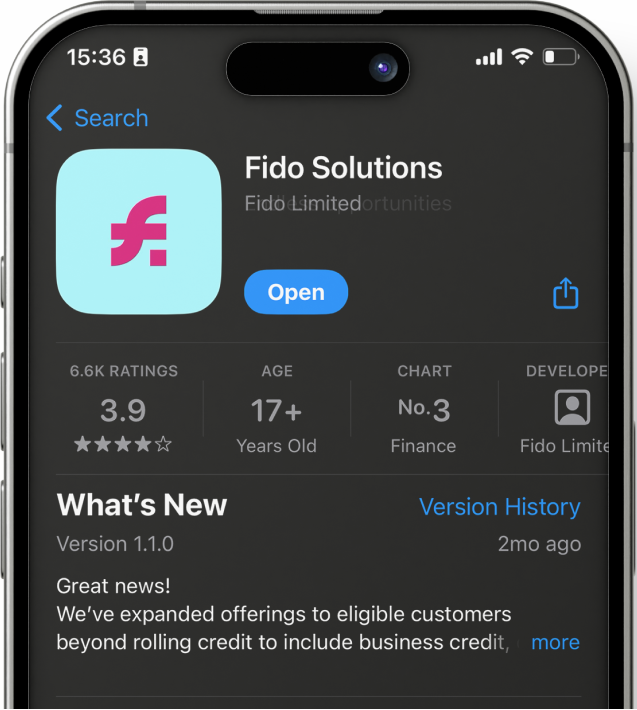

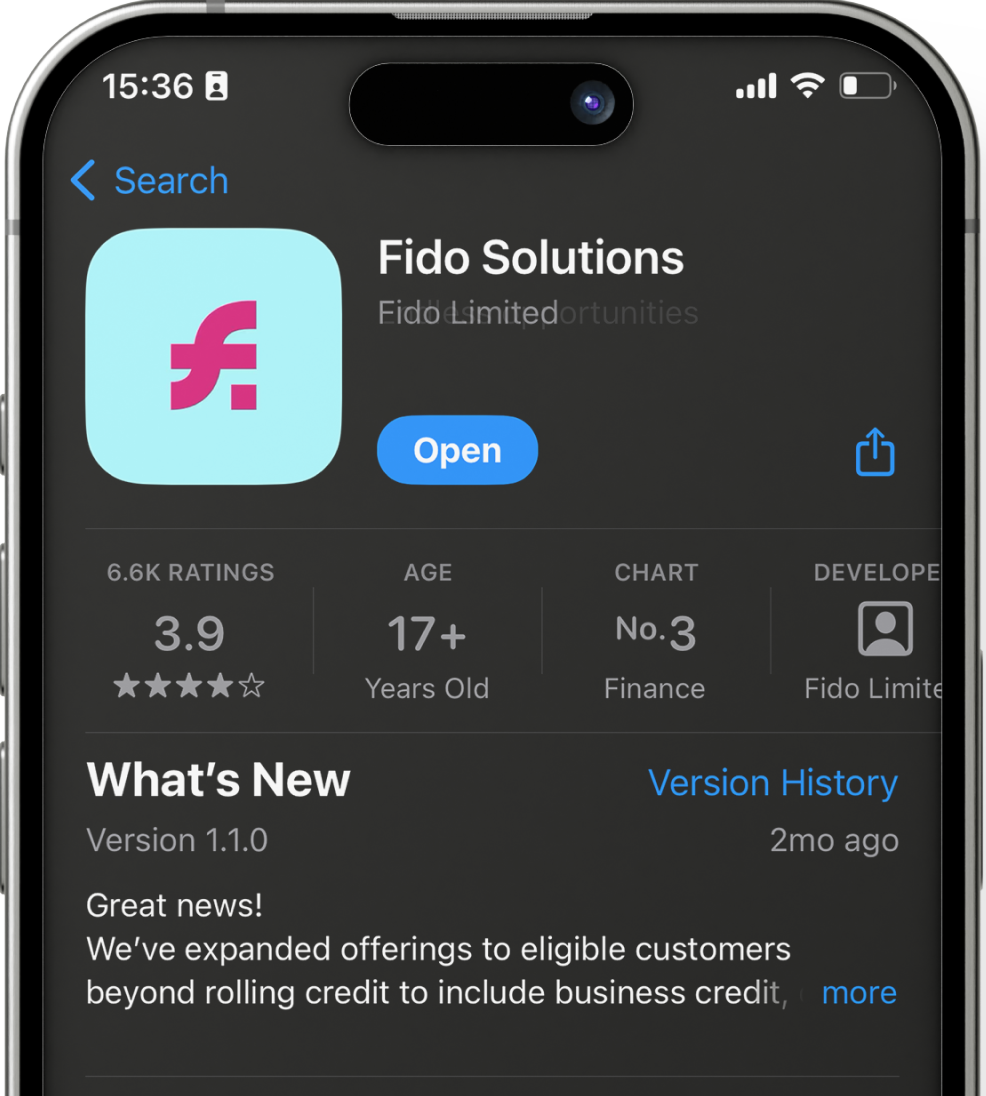

Get the Fido app today and take

control of your finances on the go.

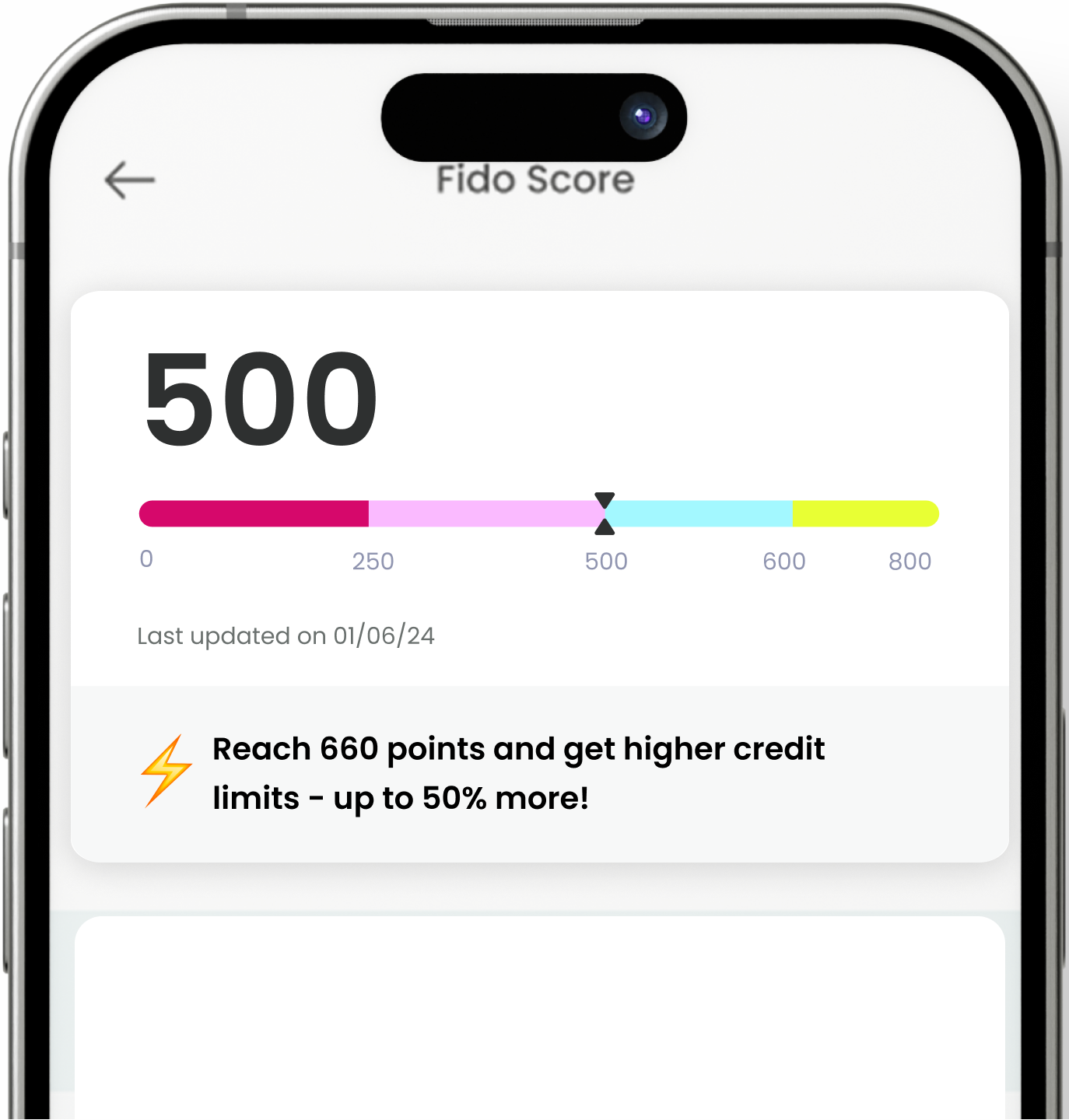

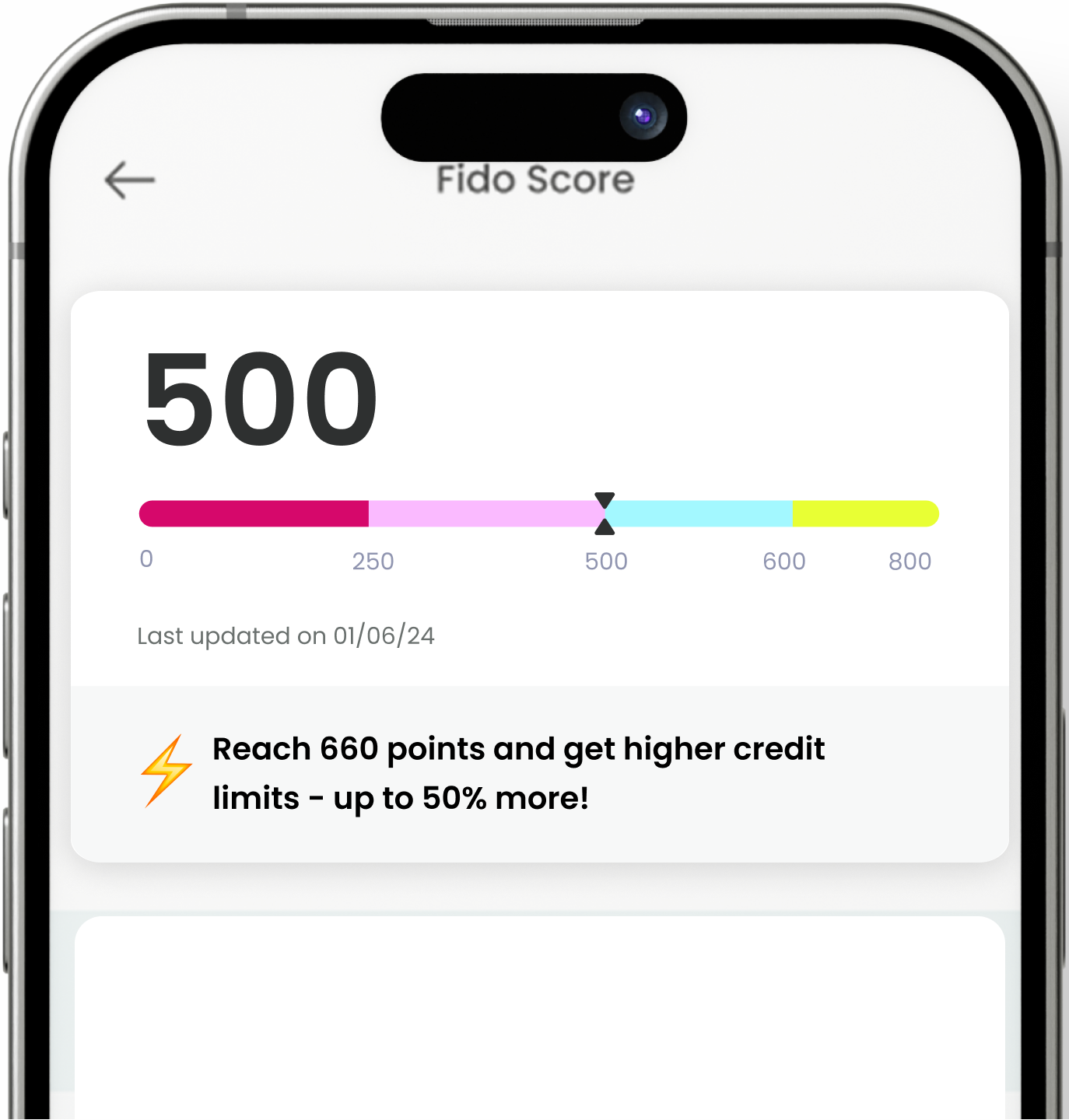

Answer a few questions to unlock our services. The better you score, the more you get.

Get the Fido app today and take

control of your finances on the go.

Submit your selfie, Ghana card

and address.

Answer a few questions to unlock

our services. The better you score,

the less you pay.